Glassnode conducted an analysis and concluded that Bitcoin has established a solid support level at $30,000, and the current market structure resembles the situation in early 2016 and 2019.

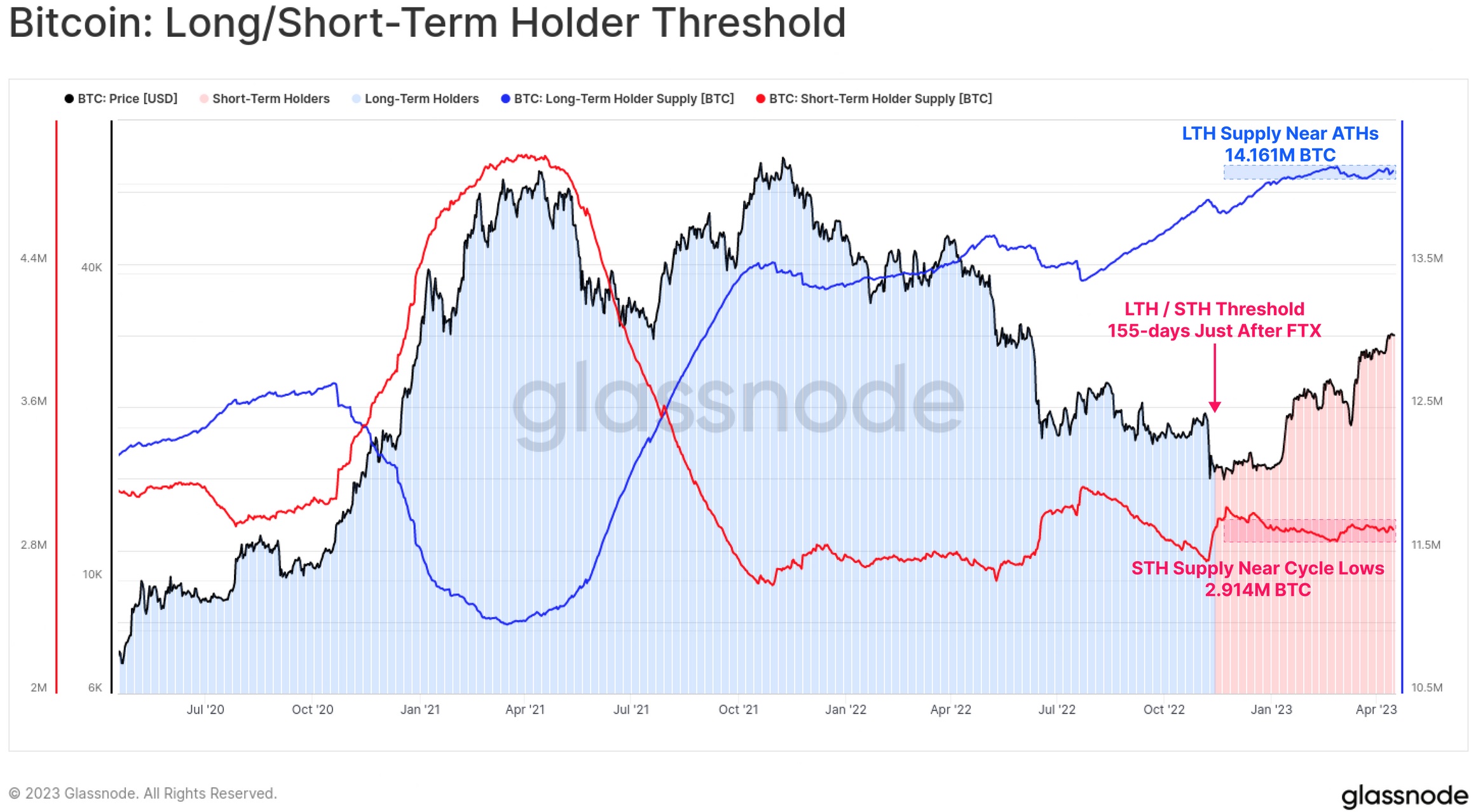

According to the study, long-term holders of Bitcoin (LTH) have barely hit a new all-time high, with a total supply of 14.161 million BTC. On the other hand, short-term holders (STH) who bought coins after the FTX crash have 2.914 million BTC, and this supply is unlikely to change in 2023.

155 days have passed since the FTX crash on November 8, 2022. This period is important as it is the minimum amount of time a coin holder must hold them to be considered a Long Term Holder (LTH). Thus, the supply of bitcoin can be divided into two categories: the first is before the crash of FTX, belonging to long-term holders, and the second is after the crash, owned by short-term holders.

We also compared the behavior of LTH in previous market cycles. It is observed that Bitcoin is currently experiencing a period of “patience plateau”, when the supply of LTH fluctuates around its historical maximum, sometimes for a long time – from several months to more than a year.

In addition, the market structure resembles the situation at the beginning of 2016 and 2019. The price of bitcoin did not make new lows in 2016 and 2019, and the actual rise began 18-24 months after the end of 2020 and 2021. A period of parabolic growth usually indicates a rapid increase in the share of assets in LTH in profit, followed by profit taking.

Glassnode research has shown that Bitcoin is currently in a “patience plateau” where long-term holders tend to keep their coins in profit. This provides a strong underlying basis for buyers below $30,000 as a total of 6.2 million BTC returned to profitability in 2023, representing 32.3% of the total supply. The supply structure also bears similarities to early 2016 and 2019 when actual growth did not start for 18-24 months. Glassnode emphasizes the importance of patience in the market cycle, as the supply of long-term holders is a critical factor to consider when analyzing the market. However, despite the fact that the price increase may not come soon, bitcoin is unlikely to fall below the $15,500 level.